Highest Paid Doctors In Canada

Canada has developed a reputation for being one of the world’s friendliest countries. Not only that, but it’s one of the safest places to reside in the world. Canada has always been a country for those who desire to live with clean air, high living standards, and safe streets. Canada welcomes newcomers with open arms as it believes in providing them with equal opportunities to excel in their new homes. Every year, Canada welcomes more than 200,000 immigrants who are given permanent residence status on arrival. Canada also provides an excellent environment that can help people improve their lives and careers, and the Canadian government, on the other hand, has several policies in place which allow easy access to citizenship for skilled and unskilled workers.

According to the Canadian Charter of Rights and Freedoms, all people, cultures, and beliefs are treated equally and without discrimination in Canada. Because Canadians value all cultures, all religious holidays and festivals are observed in the country. It doesn’t matter where you come from; you can find and enjoy your culture here. Canada is renowned across the globe as a peace-loving country that only uses military force when it is necessary to protect civilians. Our caring heritage is something we are proud of, and it is reflected in our people. The free healthcare system in Canada is well-known. Everyone in Canada has access to free health care, regardless of where they live. There is no charge for routine check-ups at the doctor’s office or surgery!

Canada has a shortage of locally trained medical staff at the moment, meaning there is a huge demand for physicians (also known as general practitioners or family physicians) in the country. Given their importance and scarcity, this is one of the best-paying jobs in Canada right now. To practice medicine in Canada, doctors need to pass the Medical Council of Canada Qualifying Examination (MCCQE) part 1 exam. The good news is that Ace question bank has got your back. The Ace Qbank is the only Canadian question bank that has signed questions based on the medical council of Canada (MCC) objective to facilitate preparation for the MCCQE1 exam and help Canadian and international graduates (IMGs) to reach their dream job. Here at Ace Qbank, we go the extra mile to craft and present a quality while we make sure it is updated with the latest changes.

This article is going to discuss the highest-earning medical specialities in Canada. However, without understanding financial jargon, a salary is just a number, and it’s difficult to see the complete picture. Therefore, in this article, we will discuss the following topics:

- Financial term

- Highest earning specialty

- The Work environment in Canada

- The Benefit of working in Canada

- Process of certification in Canada

Let’s begin by explaining a few fundamental definitions from the finance sector.

What Exactly Is The Meaning Of A Salary?

Employees receive a set sum of money (salary) as compensation for the work they perform for their employers. Salary is frequently provided in predetermined periods, such as monthly installments, as mentioned in an employment contract. Today, the notion of a salary is evolving as part of a system of total compensation that corporations give to employees, which includes bonuses, incentive pay, commissions, benefits, and a variety of other measures that enable employers to link incentives to measurable performance.

What is a base salary?

A base salary is an amount you may expect to get paid for your time or skills. This is the total amount earned before benefits, incentives, or other forms of compensation are included. The base salary is calculated on an hourly, weekly, monthly, or annual basis.

Remember that a base salary is often a predetermined amount of money that might vary widely based on the province, the geographic location of the hospital, the responsibilities as well as years of experience.

What are gross income and net income?

Gross income and net income are two additional important financial phrases to comprehend when it comes to employment earnings. The amount received based on your base salary and any financial bonuses is often referred to as gross income. Net income, on the other hand, is normally the lower figure; it is the amount remaining after all applicable deductions have been made (such as tax and insurance). Gross income is not a good indicator of the compensation packages available for different medical specialties, but it contains all of the pieces that make up a compensation package, which will be explored in depth later.

In a nutshell, gross income refers to the overall amount you earn from your paycheck, whereas net income refers to the amount you receive after deductions.

What are compensation packages?

A compensation package is an overall breakdown of all benefits and income offered by your employer, including your base salary, gross income, and other bonuses. It’s important to analyze the complete compensation package, not just the basic salary when evaluating the appropriateness of a new career. The following are some of the typical advantages:

- Sick leave

- Health insurance

- Pension plans

- Bonuses

- Academic activities such as teaching, research

Basic salary often is determined by clinical skills, qualifications, and years of experience. In more expensive locations, salaries are often higher to cover the higher cost of living. Salary is important (of course), but don’t overly focus on salary numbers. Instead, focus on your interest and choose specialties that you are really passionate about. The medical specialty makes you go to bed early at night, so you can rise up the next day just to spend all your energy practicing it with enthusiasm and joy. Medicine is challenging, fast-paced and demands are high. If someone chooses a residency program merely based on an annual salary, then every day will be a difficult day.

How are doctors compensated in Canada?

Because healthcare remains a province-by-province responsibility, Canada has a universal healthcare system with a uniform payment system for all provinces and territories. Each province manages and pays for its own healthcare system. Physicians’ earnings in Canada are highly dependent on the province in which they practice.

In Canada, physicians are primarily compensated based on the services they offer; the fee-for-service system (FFS) provides for the majority of physician payments, the most common of which are consultations and procedures. But this is changing as the focus shifts to preventative treatment throughout Canada from coast to coast, which means primary care physicians, such as family doctors, will receive the most funding since they will provide the most services than other specialities.

In Canada, there is a payment mechanism known as alternative payment plans. This sort of compensation is typically employed when a physician participates in academic activities in addition to their practice. In general, they reward physicians who lecture or conduct research by combining fee-for-service with a fixed income.

Why do physicians have the highest-paying jobs in Canada?

What are some reasons why physicians are paid so much? One good answer to this question would be that doctor’s jobs require intensive training that takes years to complete. The other reason is that they are seen as an essential part of society since they usually save lives. Doctors are becoming more specialized with time, which means that there is a lot more demand for them now, and this will only grow in the future.

Doctors who graduate from medical school have no obligation to work in Canada if they don’t want to, so there is a lack of pooling doctors in one area. As a result, those who stay and provide services receive higher wages as compensation and an incentive.

What is a doctor’s average salary in Canada?

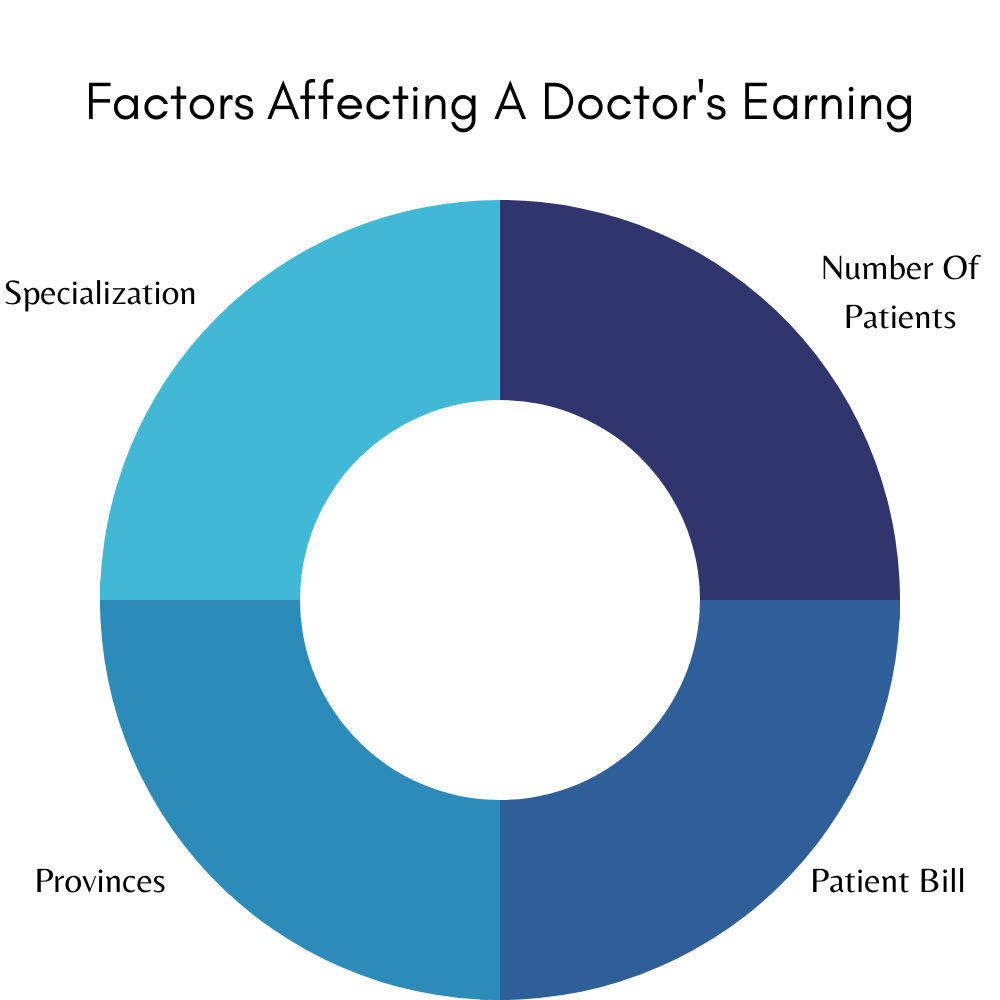

Doctors’ salaries in Canada are influenced by a variety of variables. These include the province in which they work, their years of experience, and the type of practice they have. For example, family physicians in Quebec earn less than those in Ontario. In addition, specialists tend to earn more than general practitioners. Here are five examples:

1- Number of Patients per day

Most physicians work on a fee-for-service (FFS) model, according to the Canadian Institute for Health Information (CIHI). Physicians can bill the government for each patient they visit under this model. They collect a fee per service and then file a claim with the government for reimbursement. The income of a typical doctor is determined by the number of patients they see in a day, the type of service they provide, and the province where they practice. In general, family doctors see more patients per day than other specialists, but specialists may bill at a higher rate per patient. Consequently, a doctor’s income depends on the number of patients they can treat, the hours they work, as well as the amount they charge.

2- Medical specialty

The medical speciality will determine the rate physicians charge, and usually, people with higher speciality work for a higher hour. For instance, a small leak of a coronary artery from the suture after Coronary artery bypass graft surgery (CABG) will reveal itself 3- hours after cardiac surgery, and the only way to fix the issue is to open the chest and fix the problem. Let’s say open heart surgery was done in the morning, and a leak was detected late afternoon. The operation should be done in the evening. So cardiac surgeon will perform the operation twice, but the cardiac anesthesiologist is on-call the entire time his the one who is constantly monitoring the patient after surgery and notice the coronary artery leak if there is any. Control the situation and order the surgery. Cardiac surgeons and anesthesiologists wrestle with a problem like this every now and then to save patient life. Another example is a Vascular surgeon who repairs Abdominal Aortic Aneurysm (AAA) and so on.

Keep in mind higher-paying specializations often require more years of studying, more hours of work, and a more stressful working environment. Not every single surgery goes smoothly; sometimes, complications happen. After calculating net income, certain specialties may make more in terms of doctor career compensation despite earning less per hour than others (the higher is the risk, the higher is insurance and additional fee).

3- Province

The annual income of a physician in provinces like Alberta, British Columbia, and Saskatchewan is much higher than in other provinces of Canada. While these provinces are some of the top-earning provinces for physicians overall, healthcare options are more limited in these provinces, i.e., not as many doctors, hospitals, private practices, and other medical facilities.

True, a doctor’s compensation will certainly vary depending on the province and location in which they practice, but those salaries are higher for a reason. No physician would deny his or her children access to the greatest educational facilities that the community has to offer. As a result, for married physicians with children, health care, housing, and social services are always top priorities. On the other hand, doctors who are fresh out of medical school could consider working in these programs to improve their yearly salaries and get out of debt. The government will reward doctors for working in select remote areas and underprivileged populations. These programs offer student loan relief to doctors who want to work in underprivileged or rural communities around the country.

4- Alternative Payment Methods

Outside of the FFS model, physicians may be able to earn more for their services. Fix and sessional (in academic settings) salaries are examples of alternate ways. These contracts allow doctors to make additional money by doing things other than treating patients. Grants from the Medical Council of Canada, fellowships, and research stipends are some of the other ways physicians might make money. In general, alternative payment systems may vary for each doctor, but they are frequently used to provide more constant income to doctors who reside in locations with fewer patients.

5- Private Practice

Working at a hospital or for a larger health care facility might result in a higher average annual salary for a doctor because doctors who own their own medical practice receive a salary or other form of compensation for this business (private practice).

One of the most significant advantages of having your own practice is that you will be happier and have a better work-life balance. However, being financially responsible for overhead, monthly fixed expenditures, and marketing is one of the major disadvantages and reasons why many physicians do not start their own private practice. So, if you’re thinking of starting your own private practice, make sure you have the support of your legal, financial, and IT teams.

What Are The High Paid Medical Specialties in Canada?

When you’re considering a medical specialisation, you’ve probably thought about income, which is a good thing! Even if you’re really enthusiastic about your field, you’ll want to make an informed choice regarding the financial ramifications of your chosen expertise. These salaries are meant to give you an idea about how much you could possibly earn. However, your salary will frequently be determined by your clinical expertise, abilities, and years of experience. Here are some of the salaries in Canada per specialization:

| Specialities | Salary |

| Ophthalmology | $691,000 per year |

| Thoracic/Cardiovascular | $588,000 per year |

| Neurosurgery | $558,000 per year |

| Urology | $500,000 per year |

| Surgeon | $466,000 per year |

| Anesthesiologist | $417,000 per year |

| Obstetrics/gynecology | $392,000 per year |

| Dermatology | $385,000 per year |

| Internal Medicine | $362,000 per year |

| Neurology | $316,000 per year |

| Pediatrician | $296,000 per year |

| Psychiatry | $282,000 per year |

| Family Medicine | $270,000 per year |

| Pediatrician | $296,000 per year |

| Registered Nurses | $96,471 per year |

Let’s review a few of high earning medical specialties:

Ophthalmology

Ophthalmology is an interesting surgical specialty, and ophthalmologists provide complete medical and surgical treatment for the eyes. Patients with ophthalmic diseases range in age from preterm newborns to the elderly. Patients are typically healthy, and their diseases are only life-threatening in rare cases. However, acute emergencies such as a blown eye from a bar fight, acute glaucoma, or foreign substance penetration of the cornea do occur from time to time which requires immediate intervention.

Strabismus/pediatric ophthalmology, glaucoma, neuro-ophthalmology, retina/uveitis, anterior segment/cornea, oculoplastics/orbit, and ocular oncology are all subspecialties of ophthalmology.

Neurosurgery

It’s a common misconception that neurosurgeons spend all of their time performing surgery. They actually have a lot of other duties since neurosurgeons are experts in the nervous system. They work with patients of various ages; some illnesses are life-threatening, while others are chronically debilitating. For instance, neurosurgeons often consult emergency room doctors and neurologists regarding their cases and help evaluate and rehabilitate people with neurological conditions. They also have their own set of cases, each with its own set of difficulties.

Neurosurgery is a difficult surgical specialty that is continually evolving in terms of procedures and technologies. Minimally invasive techniques involving surgical microscopes and endoscopes are becoming more common, with results that are equivalent to or better than open surgery. However, lower back discomfort, peripheral nervous system diseases, brain tumors, and carpal tunnel syndrome are among the neurological ailments that neurosurgeons manage.

Urologist

Urologists have the best of both worlds; they are surgeons, but they also treat enlarged prostates, interstitial cystitis, hyperactive bladder, and prostatitis with medication. Some urologists have additional training in reconstructive surgery, and they may treat birth defects or help patients who have been affected by accidents. The majority of urological surgery is elective, and urological emergencies are uncommon. Depending on demand and province regulations, urologists operate in private offices, hospitals, urology centers, and medical clinics.

As a urologist, you must have a good attitude and a pleasant bedside manner, as you will be doing tests and procedures that may be unpleasant for your patients, and you will be giving them news about their diagnosis that may not always be what they want to hear. Ability to speak effectively and a willingness to assist others are desirable qualities in this position. Urologists are often faced with medical situations that require them to think quickly and address the problem as best they can. So solving problems and having a keen eye for detail are important traits to possess.

Cardiothoracic Surgery

The field of cardiothoracic surgery is one of the most challenging and demanding. It’s also quite competitive, given the limited amount of available positions. Cardiothoracic surgeons collaborate closely with cardiologists, oncologists, and anesthesiologists, as well as other non-medical workers such as perfusionists, intensive care nurses (monitoring patients in intensive care is a vital part of the work), and operating room staff. It was the first specialty to employ outcome metrics to analyze and improve techniques and procedures because treatments involve a definite danger of mortality, and results can be classified along binary lines, whether the patient survives or not, and this puts a lot of pressure on a surgeon. Cardiothoracic surgery is not only surgery all day long; it also involves attendance at outpatient clinics, multi-disciplinary team meetings, and ward rounds.

How is the work environment in Canada?

Many people have chosen to work in Canada because of the abundance of employment possibilities in a variety of intriguing sectors, as well as the promise of good pay and high quality of life. Canadians are motivated and enthusiastic about what they do. Here are some facts about working in Canada that you should be aware of:

Collaboration and Integration

The friendly work culture in Canada is one of the reasons why networking is important to both Canadian and international medical graduates. The amount of interest you exhibit and the size of your network indicate your genuine interest and help you find a suitable position following graduation or passing the qualification exam in the case of an international graduate. Collaboration and integration are important aspects of a continuous journey as well as effective service delivery. They do, however, need a joint focus and a dedicated driving force to keep both going ahead and generating value for the patient. As our working environments evolve as a result of the combined forces of technological innovation and patient demand, collaboration and integration will become increasingly important.

Fair work hours

In Canada, like in many other countries, the usual workweek is Monday through Friday, 9 a.m. to 5 p.m. However, in Canada, teamwork among coworkers is highly valued. Employees are frequently treated fairly by managers, and criticism from them is always accepted. Punctuality is also highly valued; thus, you should keep to the schedule provided.

Communication

It is important to maintain a positive attitude towards your supervisor, coworkers, and duties all the time since managers place a high value on the work environment. If you are not completely happy with an answer or don’t understand anything, it is recommended that you ask further questions.

If you find a position, your teamwork skills will be put to the test in the workplace. We will all become stuck at work at some time, but someone with strong communication skills and a team player attitude may ask for help advice and accomplish the task at hand. If your team is having difficulty communicating, on the other hand, asking for help might be a stressful process. When trust concerns go unaddressed, it may stifle everyone on the team, preventing them from going ahead and leaving tasks unfinished. Therefore Communication is the key.

What Are The Benefits Of Living In Canada?

Canada is a country that cares about its citizens’ well-being. The government of Canada offers a series of social well-being programs. Canada provides the following social services in addition to a free medical assistance program and education for children:

Canada Pension Plan (CPP):

In Canada, the Canada Pension Plan (CPP) is one of the three components of the retirement income system. This taxable government benefit, which was established in 1965, provides a basic benefits package to Canadian retirees and handicapped contributors. This reliable system is in charge of providing retirement and disability payments to Canadians all around the country. It’s an important aspect of managing payroll as an employer. Almost every Canadian citizen, similar to employment insurance, pays mandatory CPP contributions after being able to work in Canada. The amount of the contribution is determined by the individual’s wage.

When you retire, the CPP retirement pension is a taxable monthly payment that replaces a portion of your income. If you qualify, the CPP retirement pension will be paid to you for the rest of your life.

Registered Retirement Savings Plan (RRSP):

First, let’s go over some fundamentals: RRSP stands for Registered Retirement Savings Plan. As for “registered,” that refers to the registration with the federal government. Due to their registered status, RRSPs qualify for certain tax benefits that simplify the process of saving for retirement. In Canada, an RRSP is retirement savings and investment plan for employees. The money in an RRSP is put in tax-free and grows tax-free until it is withdrawn, then it is taxed at the marginal rate. RRSPs are governed by their contents. The contents of an RRSP govern its growth. In other words, having money in an RRSP does not guarantee a comfortable retirement; however, the investments will compound tax-free if the funds are not withdrawn.

The Canadian government has provided this tax deferral to Canadians in order to encourage them to save for retirement, reducing their dependence on the Canadian Pension Plan. That’s because it’s a win-win situation for your money. In addition to possibly decreasing your annual tax bill, investing in RRSPs provides a compounding, tax-free return on your investment while the money is in your account. And the greatest thing is…. As soon as you start earning money and file your tax return with the Canada Revenue Agency (CRA), you can start contributing to an RRSP investment.

Employment Insurance (EI) maternity benefits:

Biological moms who are unable to work because they are pregnant or have just given birth are eligible for EI maternity and parental payments. EI maternity payments are offered for a maximum of 15 weeks. The 15-week period can begin as early as 12 weeks before the due date and can end as late as 17 weeks beyond the due date.

There are two types of parental benefits available: basic and extended

Standard parental benefits are only available for a maximum of 35 weeks and must be claimed within 52 weeks of the child’s birth. Biological parents are eligible for the benefits.

Extended parental payments are available for a maximum of 61 weeks and must be claimed within 78 weeks of the child’s birth. Biological parents are eligible for the benefits.

Note: If you have multiple children (twins, triplets, etc.), the number of weeks of EI maternity benefits eligibility does not alter.

What are the steps towards becoming a registered doctor in Canada?

There are numerous steps you may take to start the process of becoming a practicing physician as an international medical graduate or international medical student; We attempted to make these steps as simple as possible for you. The steps are as follows:

1) Medical degree

Check whether Canada recognizes your medical degree by searching in the World Directory of Medical Schools (WDMS) for your medical school. This is the indication that Canada recognizes your medical school if you find “A Canada Sponsor Note” for it.

2) physiciansapply.ca account

To open a physiciansapply.ca account, you must first sign up for a physiciansapply.ca account and pay a one-time, non-refundable $290 for this. After signing up, you’ll be able to go into your account and request a variety of services, including document sharing, MCCQE1 exam application, and more.

3) Submit medical diploma

Verify your medical credentials by submitting them to the Medical Council of Canada and request an Educational Credential Assessment (ECA) report from your physiciansapply.ca account before submitting your medical credentials to any provincial/territorial medical regulatory bodies and other organizations in the Canadian medical system.

4) Qualifying Examination MCCQE Part 1

Take the MCCQE1 exam. MCCQE1 is a one-day, computer-based exam that assesses the critical medical knowledge and clinical decision-making ability of a doctor at a level expected of a medical student who completed a medical degree in Canada. You can apply for the MCCQE exam through your physiciansapply.ca account. The MCCQE1 exam is available in over 80 countries at over 500 test centers worldwide, and the MCCQE1 costs $1,330 to apply for.

5) National Assessment Collaboration (NAC) Examination

Take the NAC Examination. Only IMGs who wish to apply for a residency position in Canada must take the NAC Examination. This test is available in Canada. It’s a one-day test that determines if overseas medical graduates are ready to pursue a residency program in Canada. The application price for taking the NAC test is $2,945.

6) Get Licentiate of the Medical Council of Canada

IMGs doctors can receive the Licentiate of the Medical Council of Canada after completing both the MCCQE1 and the NAC examinations (LMCC). Having the LMCC does not grant permission to practice medicine in Canada. Only Canadian medical regulatory authorities have the authority to grant a medical license that authorizes a doctor to practice in their province or territory. In most cases, LMCC is necessary in order to apply for a residency program either through CarMs or ready to practice program.

7) Practice-ready assessment (PRA) program

Apply for a PRA program. IMGs doctors who completed their postgraduate clinical medical training outside of Canada and have significant clinical experience can apply for practice independently for the following practice-ready PRA programs:

- Alberta Clinical and Surgical Assistant Program

- Alberta International Medical Graduate Program

- Collège des médecins du Québec – Practice-ready assessement

- Clinical Skills Assessment and Training Program (Newfoundland and Labrador)

- HealthForceOntario Access Centre

- IMG-BC Program

- Medical Licensure Program for International Medical Graduates (Manitoba)

- Saskatchewan International Physician Practice Assessment (SIPPA)

- Touchstone Institute (formerly Centre for the Evaluation of Health Professionals Educated Abroad) (Ontario)

8) Canadian Medical Regulatory Authority (MRA):

Doctors are a regulated profession in Canada; therefore, you’ll need to understand how to become a registered doctor in Canada. International medical graduates can only practice in Canada after receiving licensure from the MRA. You can do so by contacting the regulatory authority in the province or territory where you plan to live. Many provinces also offer international medical graduate (IMG) programs that can assist you with the application process. There are separate MRAs and regulations in each province and territory in Canada. The following are the provincial medical regulatory authorities in Canada:

- College of Physicians and Surgeons of Alberta

- College of Physicians and Surgeons of Newfoundland & Labrador

- Collège des médecins du Québec

- College of Physicians and Surgeons of Manitoba

- College of Physicians and Surgeons of British Columbia

- College of Physicians and Surgeons of New Brunswick

- College of Physicians and Surgeons of Nova Scotia

- College of Physicians and Surgeons of Ontario

- College of Physicians and Surgeons of Prince Edward Island

- College of Physicians and Surgeons of Saskatchewan

- Government of Northwest Territories

- Government of Nunavut

- Yukon Medical Council

Depending on the specialty and program, a residency might last anywhere from three to seven years. Many doctors believe that residency is a vital challenge that helps you build skills that you’ll need for the rest of your career. After the residency program, you can either start practicing or apply for a fellowship position if you want to specialize further. Post-residency training program requirements in Canada vary greatly by specialty and province, so applicants should carefully research the criteria for each program they’re considering to verify they’re eligible.

Need Help With Your MCCQE 1 Exam Preparation?

Proper preparation is essential for success on the MCCQE1 exam, and you should make every effort to earn the maximum possible score on the MCCQE1 exam. If you’re having trouble keeping to your study plan or if certain objectives are challenging for you, get the help you need to pass the MCCQE1 exam on the first attempt.

Ace Qbank has got your back with over 2100+ high yield questions, many Clinical Decision-Making (CDM) cases, and several self-assessments available to challenge and push you to your limit.

To facilitate preparation for the MCCQE1 exam, we developed the Ace Qbank based on the Medical Council of Canada (MCC) objectives. Our team reviews the question bank regularly based on current guidelines and recommendations, and we implement any changes we make as soon as possible to enhance your learning experience. Our objective is to keep the information up to date and in compliance with medical standards of care to avoid surprises during the test. At Ace Qbank, we’ve got you covered.

We invite you to sign up for the Ace Qbank demo today and see the difference our elite question bank makes!